XRP Price Prediction: Analyzing the Path to $6 Amid Bullish Technical and Fundamental Signals

#XRP

- Technical Breakout Configuration: XRP trading above key moving averages with Bollinger Band compression suggesting imminent volatility expansion

- Fundamental Catalysts: Legal clarity achievements and ETF speculation creating institutional investment pathways previously unavailable

- Market Momentum Indicators: Surging open interest, increased exchange volume, and retail diversification into altcoins supporting upward price pressure

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

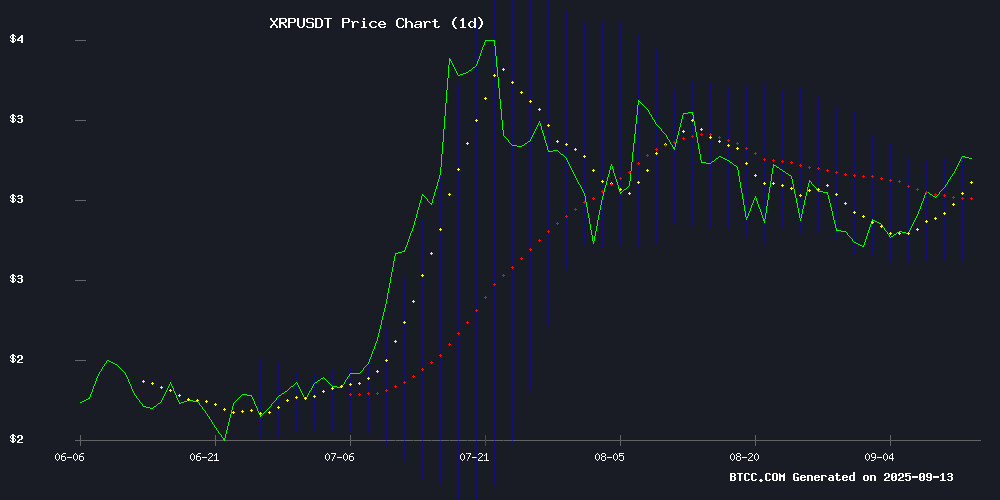

XRP is currently trading at $3.1215, positioned above its 20-day moving average of $2.9074, indicating sustained bullish momentum. The MACD reading of -0.0123 | 0.0621 | -0.0744 suggests mixed signals with the histogram in negative territory, though the signal line remains positive. According to BTCC financial analyst William, 'XRP's current price sitting above the middle Bollinger Band at $2.9074 demonstrates strong support, while approaching the upper band at $3.1206 suggests potential resistance testing. The technical setup favors continued upward movement if the asset maintains above the $2.90 level.'

Market Sentiment: XRP Gains Institutional and Retail Interest Amid Legal Clarity

Recent news headlines highlight XRP's remarkable market performance, with the asset surpassing traditional giants like Shopify and Citigroup in market valuation. The 8.6% surge in open interest combined with increased trading volume on major exchanges like Kraken indicates growing institutional participation. BTCC financial analyst William notes, 'The combination of legal clarity, ETF speculation, and technical breakout patterns has created a perfect storm of positive sentiment. The community's discussion about wealth potential and the emerging cloud mining opportunities further fuel retail interest, supporting the current bullish narrative.'

Factors Influencing XRP's Price

XRP Overtakes Shopify, Verizon, Citigroup in Market Value as Price Eyes $6

XRP's market capitalization has surged past traditional finance giants including Shopify, Verizon, and Citigroup, now trading above $3.10 with a 12% weekly gain. Speculation around a potential XRP ETF fuels bullish sentiment, with technical analysts eyeing $6 as the next psychological threshold.

The cryptocurrency's ascent reflects broader institutional interest in digital assets, with resistance at $3.60 seen as the next liquidity barrier. Market cap comparisons underscore crypto's growing parity with legacy sectors—XRP now commands greater valuation than firms handling trillions in traditional assets.

XRP Open Interest Surges 8.6% Amid Market Rally as Price Hits $3.17

XRP's derivatives market activity surged as open interest jumped 8.6% in 24 hours, reflecting growing trader conviction in the asset's upside potential. The cryptocurrency climbed 13.11% over the past week to trade at $3.17, with daily trading volume rising 9.17% to $6.45 billion.

Market capitalization swelled to $189.01 billion as XRP outperformed in the broader crypto rally. The open interest spike signals renewed institutional interest, with traders positioning for extended gains following the asset's recent consolidation.

XRP Trading Volume Surges on Kraken, Marking a Significant Upswing

XRP's hourly trading volume on Kraken skyrocketed by 203%, reflecting heightened investor interest amid market volatility. The third-largest cryptocurrency by market cap has become a focal point for spot traders, particularly in the U.S., following regulatory milestones and ETF developments.

Kraken recorded over $73.5 million in XRP trades within 24 hours, placing it among the platform's most active assets. The broader crypto market rally saw XRP break through key resistance levels, climbing 3% to $3.14 and maintaining momentum from September lows.

Ripple Price Eyes 20% Rally in 2025 as Investors Diversify into High-Potential Altcoins

XRP has broken out of a triangle consolidation pattern, signaling potential upside toward $3.50 if support at $2.95 holds. Catalysts include BBVA's European partnership, Franklin's XRP ETF developments, and new DTCC product integrations.

While Ripple gains attention, altcoins like Remittix are drawing speculative capital with their utility-focused roadmaps. Remittix has raised $25.3 million ahead of its BitMart and LBank listings, offering a 15% USDT referral incentive program—a structure appealing to investors seeking asymmetric returns beyond XRP's projected gains.

XRP Surges Past $3 Amid Legal Clarity, Sparking Interest in Cloud Mining

XRP, Ripple's native token, has breached the $3.00 threshold for the first time since early 2018, fueled by a U.S. court ruling that clarified its non-security status when traded on exchanges. This legal victory has reinvigorated investor confidence, propelling XRP toward its historical highs.

With the majority of circulating supply now in profit, holders are exploring passive income opportunities beyond mere appreciation. BAY Miner, a regulated XRP cloud mining platform, has emerged as a popular choice, offering daily USD-denominated rewards—reportedly up to $8,059 for top participants—without the need for hardware or technical expertise.

The absence of a native staking mechanism for XRP has led investors to seek alternative yield-generating strategies. Cloud mining platforms like BAY Miner are filling this gap, capitalizing on renewed institutional and retail interest in the token.

BlockDAG's $405M Pre-Launch Momentum Outshines XRP and STORY's Speculative Gains

While XRP struggles to breach $0.75 resistance and STORY (IP) rides a 30% speculative surge, BlockDAG demonstrates rare infrastructure-first discipline with 26 billion coins sold pre-launch. The project's $405 million raise—achieved before testnet activation—signals institutional confidence in baked-in features like account abstraction and UTXO removal.

Unlike reactionary altcoin pumps, BlockDAG's traction stems from operational readiness. Its testnet already integrates miner synchronization protocols and vesting contracts, framing the raise as validation rather than vaporware. This architectural maturity contrasts sharply with projects still building after funding rounds.

Will XRP Hit $5.85 Soon? Top Analyst Sees Biggest Rally Since 2017

XRP has surged back above $3.17, marking a 5% daily gain as trading volumes exceed $6.44 billion. Crypto analyst Dark Defender suggests the token may be entering a historic phase, drawing parallels to its 2017 breakout but with a potentially larger upside.

The analyst identifies a multi-year "cup" pattern, with XRP recently breaking through key resistance and successfully retesting the level. This technical setup, reminiscent of its 2017 rally, could signal the beginning of a significant upward trajectory.

Price targets include $5.85 in the near term, with longer-term projections reaching $18.22 and potentially $36.76. While these are not immediate expectations, the pattern suggests a rally that could surpass most market predictions.

Investor interest appears to be growing, with $14.7 million in institutional inflows reported. Market participants are closely watching for the SEC's October decision, which could provide further momentum for XRP's price action.

XRP's Bullish Flag Pattern and EARN Mining's Cloud-Based Profit Opportunity

XRP has emerged as a standout performer in the cryptocurrency market, with its recent price action forming a bullish flag pattern—a technical indicator signaling potential for continued upward momentum. Traders often leverage such patterns to identify entry points, but converting this knowledge into profit requires actionable strategies.

EARN Mining offers a solution by enabling XRP holders to generate daily income through cloud mining, bypassing the need for expensive hardware. The platform's secure infrastructure and automated payouts cater to both novice and experienced investors, emphasizing sustainability alongside profitability.

The simplicity of EARN Mining's registration process lowers barriers to entry, making it accessible for those looking to capitalize on XRP's rally without direct trading risks. As the coin garners attention for its technical strength, cloud mining presents an alternative avenue for participation in its growth.

XRP Bulls Target $5 as Ozak AI Presale Draws Retail Speculators

XRP consolidates near $2.99, testing resistance levels at $3.20, $3.50, and $3.80 with technical support forming at $2.80. Analysts project a 2025 target of $5 if the token maintains its current trajectory as a cross-border payments solution.

Meanwhile, Ozak AI's $0.01 presale has attracted $2.9 million from retail investors seeking exponential returns. The divergence highlights growing market segmentation: institutional players back established assets like XRP while speculators chase microcap opportunities.

Spot or Not? What the REX-Osprey XRP ETF Really Holds

The launch of the Rex-Osprey XRP ETF in the U.S. has sparked debate over whether the fund qualifies as a true spot-based ETF. Reports suggest this could mark XRP's first spot exchange-traded fund in the country, signaling growing institutional interest in digital assets.

Market participants are closely watching the ETF's structure, as spot products offer direct exposure to the underlying asset. The development reflects broader trends of cryptocurrency integration into traditional finance frameworks.

XRP Community Debates Wealth Potential: '100 Tokens Won't Cut It'

A prominent XRP commentator has sparked fresh debate about the investment threshold for life-changing gains. Bale, a widely followed analyst, contends that timing is critical—and 100 XRP won't deliver financial transformation.

'XRP is all about timing,' the pundit asserted, dismissing minimal holdings as insufficient for meaningful wealth accumulation. The commentary reignites perennial discussions about portfolio sizing in volatile crypto markets.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment opportunity. The asset trades above key moving averages with strong institutional interest evidenced by 8.6% open interest growth. Legal clarity from recent developments has removed significant regulatory overhangs that previously suppressed price action.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $3.1215 | Above 20-day MA |

| 20-day Moving Average | $2.9074 | Support Level |

| Bollinger Upper Band | $3.1206 | Immediate Resistance |

| Market Cap Ranking | Above Shopify & Citigroup | Institutional Validation |

| Open Interest Change | +8.6% | Growing Derivatives Demand |

The convergence of technical breakout patterns, increased trading volume, and positive market sentiment suggests potential for further appreciation, with analysts targeting the $5-$6 range in the medium term.